doing good is in our dna

It’s time you felt better about where you get your insurance.

Founded on a tradition of doing good — for our clients, our employees, and our community —

we are committed to providing solutions you can rely on.

Founded on a tradition of doing good — for our clients, our employees, and our community — we are committed to providing solutions you can rely on.

personal

business

homeowners

employee benefits

individual health

financial services

by your side

When you need us, we’ll be there, right by your side,

with the responsive and insightful customer care that set the people of LD&B apart.

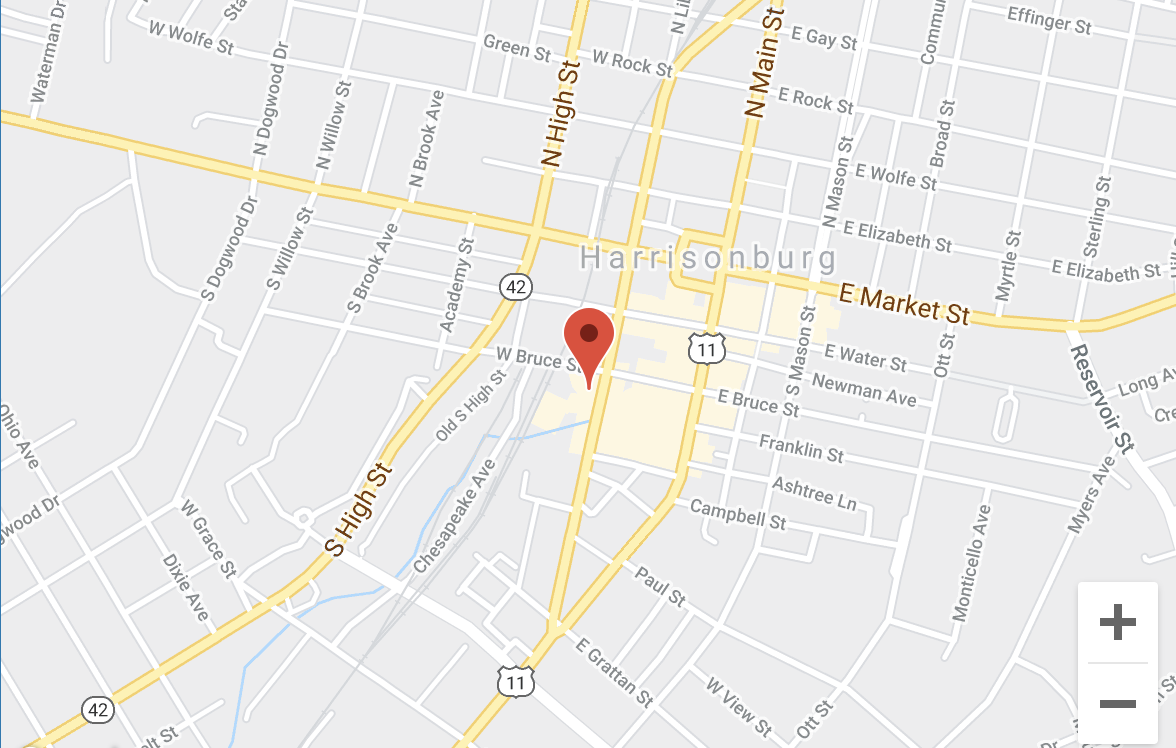

We’re here in your community, ready to understand your needs for today and goals for the future.

When you need us, we’ll be there, right by your side, with the responsive and insightful customer care that set the people of LD&B apart.

We’re here in your community, ready to understand your needs for today and goals for the future.

by the numbers

LD&B Cares

Since 1974, LD&B has been guided by a mission to do right by our customers and to do good in the communities we serve. As a local, 100% employee-owned agency, we don’t just work here — we live here. That means we care about making this a better place for our families, neighbors, and friends and give generously to the communities we serve.

community connections

FOLLOW US

News & Events

LD&B Clients Awarded for Excellence in Health Plan Stewardship

SummaryHealth Rosetta’s Rosie Award presented to LD&B clients for excellence in health plan stewardship. The Health Rosetta is an ecosystem of advisors and experts in

Safe Internet Practice: How to Watch Out & Avoid Online Scams

SummaryIn today’s digital age, scamming has become an issue for both individuals and businesses online. Online scams can come in many forms, but with the

Art Contest 2024

SummaryHave a creative kiddo?! Great news! In honor of our 50th Anniversary, LD&B is hosting our first ever art competition! Have a creative kiddo?! Great